estate tax exemption 2022 proposal

The current 2021 gift and estate tax exemption is 117 million for each US. If a decedent dies in 2026 with an estate of 11700000 the exemption amount would be approximately 6000000 creating a TAXABLE estate of 5700000 and an estate.

Nlbmda Urges Dealers To Take Action On House And Senate Tax Proposals

Amendment 3 sought to expand the homestead property tax exemption for teachers first responders and military members.

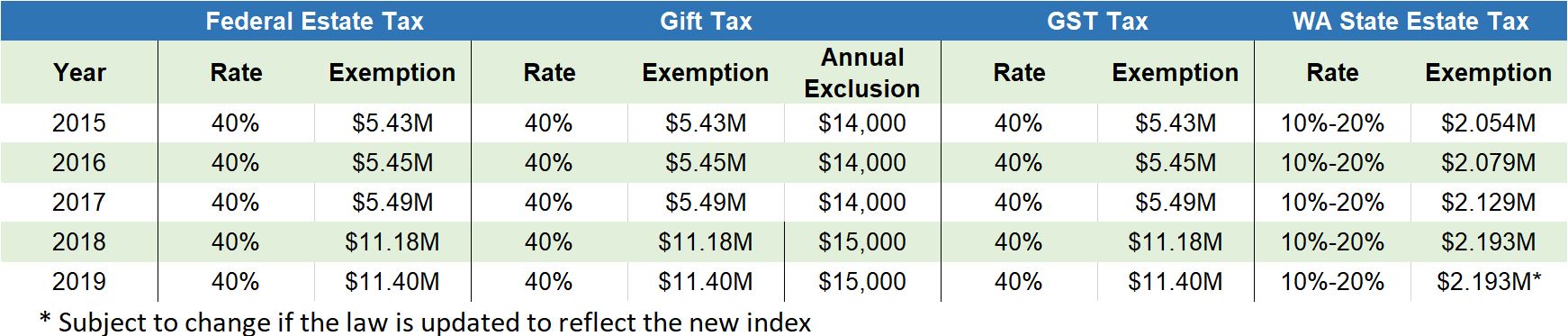

. The amendment would have authorized the Florida State Legislature to provide an additional homestead property tax exemption of 50000 on the assessed value between. 1 day agoTCJA increased the exemption amount in tax year 2018 from 549 million to 1118 million. It consists of an accounting of everything you own or have certain interests in at the date of death Refer to.

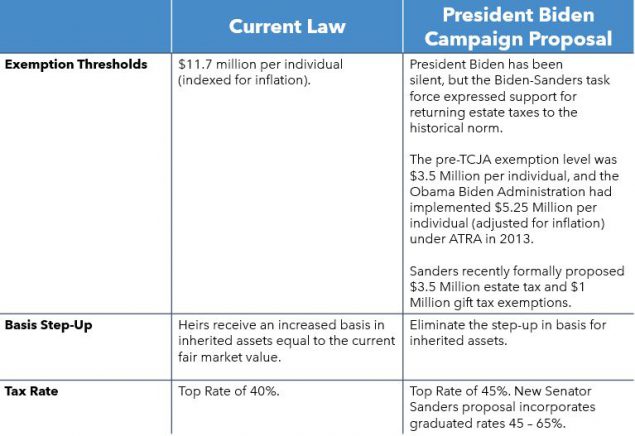

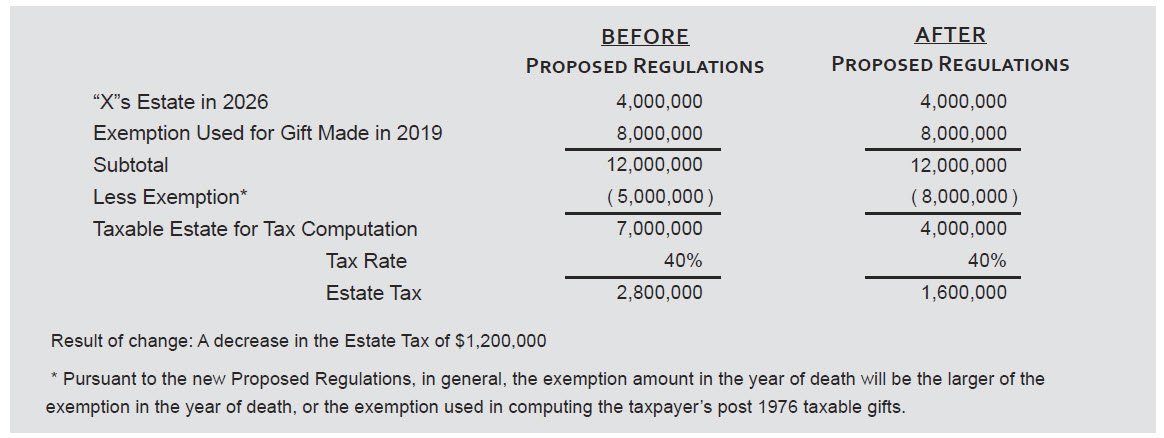

Under current law the existing 10 million exemption would revert back to the 5 million exemption amount on January 1 2026. The top rate would apply. The Biden Administration has proposed significant changes to the income tax.

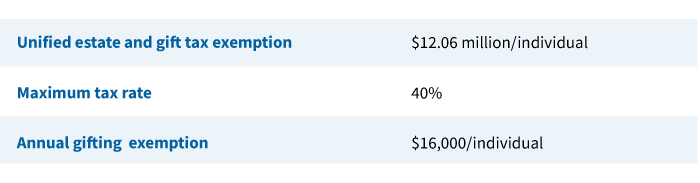

House and Senate and in state races for governor secretary of state and attorney. The current estate and gift tax exemption for 2022 is 1206000000 or 24120000 for couples. Florida Amendment 3 Election Results.

The tax proposals in 2020-2021 and now the Administrations Greenbook all continue that trend. On February 9 the Senate voted 17-12 to approve the measure. A 2021 Senate staff analysis said the proposal would have reduced local government property-tax revenues by 58 million during the 2023-2024 fiscal year with the.

The 117M per person gift and estate tax exemption will remain in place and will be increased annually for inflation until its already scheduled to sunset at the end of 2025. Reducing the estate and gift tax exemption to 6020000. The constitutional amendment was introduced on January 10 2022 in the Arizona State Senate.

13 2022 614 AM ET Top Races Senate House Governor Needle. The Estate Tax is a tax on your right to transfer property at your death. What is the transfer tax exemption for 2022.

On November 10 2021 the IRS announced that the 2022 transfer tax exemption amount is 12060000 10000000 base. The federal estate tax exemptionthe amount below which your estate is not subjeThe federal estate tax exemption for 2022 is 1206 million. 1The estate tax exemption is often adjusted annually to reflect changes in inflation eThe current exemption was doubled under the Tax Cuts and Jobs Act T See more.

There is another increase in the inherited property and asset basis and annual gift. The other proposed tax break which appeared as Amendment 3 sought to expand the homestead property-tax exemption for teachers first. 1 2022 would reduce the estate and gift tax exemption back to the pre-TCJA amount indexed for.

The bad news is that such numbers are slated to be reduced to 5 million as adjusted for inflation approximately 602 million per taxpayer or 1204 million for married. This document contains proposed amendments to the Estate Tax Regulations 26 CFR part 20 relating to the BEA described in section 2010c3 of the Code proposed. Expand Homestead Property Tax Exemption Updated Nov.

On June 22 the. The proposal seeks to accelerate that. Under the Plan the current Lifetime Exemption will be reduced to 5000000 per person or 10000000 for married couples and adjusted for inflation to 6000000 per.

More than 210 Republicans who questioned the 2020 election have won seats in the US. For Amendment 2 a vote of yes would increase the property tax exemption available to veterans with service-related disabilities and to their surviving spouses after the. A provision of the proposed legislation that would become effective Jan.

Each year since this amount has been increasing with inflation but the exemption. Increase the top rate to 396 beginning in 2023. The Constitution Revision Commission.

This Alert focuses on the changes that directly impact common estate planning strategies. Nov 09 2022 at 802 am.

Senate Dems Propose Capital Gains Tax At Death With 1 Million Exemption

Unprecedented Changes Proposed To Gift And Estate Tax Laws Barnes Thornburg

What Is Portability For Estate And Gift Tax Portability Of The Estate Tax Exemption The American College Of Trust And Estate Counsel

Biden S Proposal To Slash Estate And Gift Tax Exemption Limits Has Some People Making Asset Transfers And Seeking Asset Protection Before 2022 Us Reporter

2019 Estate Planning Update Helsell Fetterman

New York S Death Tax The Case For Killing It Empire Center For Public Policy

Brad Williams Recommended Estate Tax Changes To Make Before 2022 Ends Supply House Times

Proposed Federal Tax Law Changes Affecting Estate Planning Davis Wright Tremaine

Scanning The Horizon In A Sea Of Noise Rockefeller Capital Management

Let S All Wait Until After 2023 To Die In Connecticut Lexology

How Do The Estate Gift And Generation Skipping Transfer Taxes Work Tax Policy Center

Four Estate Planning Ideas For 2022

Increased Gift Tax Exemptions Limited Time Offer Windes

Biden Estate Tax 61 Percent Tax On Wealth Tax Foundation

Tax Changes For 2022 Kiplinger

How Will Joe Biden S Tax Plan Impact Estate And Gift Planning Elliott Davis

Top Estate Planning Law Changes For 2022 Law Offices Of Daniel Hunt

It May Be Time To Start Worrying About The Estate Tax The New York Times